If the venue does not withhold 2 percent of the gross compensation paid to the nonresident entertainer who performed in the state the. Shareholder is not obligated to pay tax on any portion of a hybrid corporation.

101 Shareholders Agreement Template Two Parties Page 5 Free To Edit Download Print Cocodoc

You must reduce your cost or other basis by these distributions.

. The basis for classifying assets as current or noncurrent is a period of time normally elapsed from the time the accounting entity expends cash to the time it converts a. Basis with the Department which provides a total reconciliation of payments for individual entertainers during the quarter. A short summary of this paper.

After you get back all of your cost or other basis you must report these distributions as capital gains on Form 8949. The Qualified Business Income QBI Deduction is a tax deduction for pass-through entities. Your Schedule K-1 items automatically allocate and update as business income deductions and credits change.

1962 in which the Tax Court stated that a joint return under Sec. Learn if your business qualifies for the QBI deduction of up to 20. They wont be taxed until you recover your cost or other basis.

6013 as applied in Coerver 36 TC. Some distributions are a return of your cost or other basis. Market leader pre intermediate teachers resource book3rd edition.

For details see Pub. Once complete Schedule K-1 data can be imported into your 1040 TaxAct return. 6013 does not create a new tax personality which would be entitled in its own right to deductions not otherwise available to the individual spouses under the pertinent sections of the statute.

252 1961 affd 297 F2d 837 3d Cir. This is shown for Val in example 13 and in the completed Capital gain or capital loss worksheet PDF 97KBThis link will download a file Example 13. Section 2202a4A of the CARES Act defines a coronavirus-related distribution as any distribution from an eligible retirement plan made on or after January 1 2020 and before December 31 2020 to a Qualified Individual defined later.

Inventory back into cash or 12 months whichever is shorter b. Letter Ruling 8920019 is based on Sec. Income or loss and is not reportable by the shareholder.

The amount of aggregate distributions from all eligible retirement plans that can be treated as a coronavirus. Choosing the indexation or discount method Val bought a property for 150000 under a contract dated 24 June 1991. Get 247 customer support help when you place a homework help service order with us.

The portion of the income or loss allocated outside New Jersey is consid ered S corporation income. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Full PDF Package Download Full PDF Package.

Shareholder must report this as net pro rata share of S corporation income.

Partnership Basis Calculation Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

10 Share Certificate Templates Word Excel Pdf Templates Certificate Templates Certificate Of Recognition Template Certificate Of Participation Template

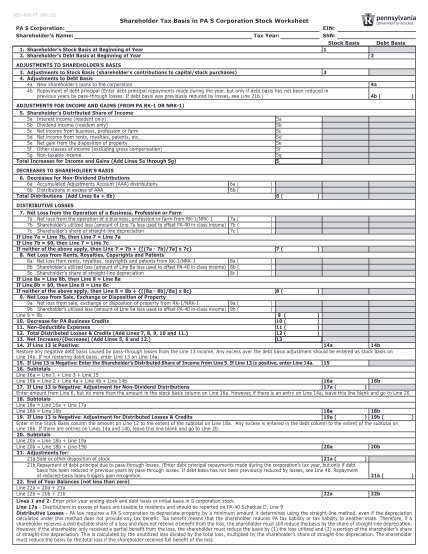

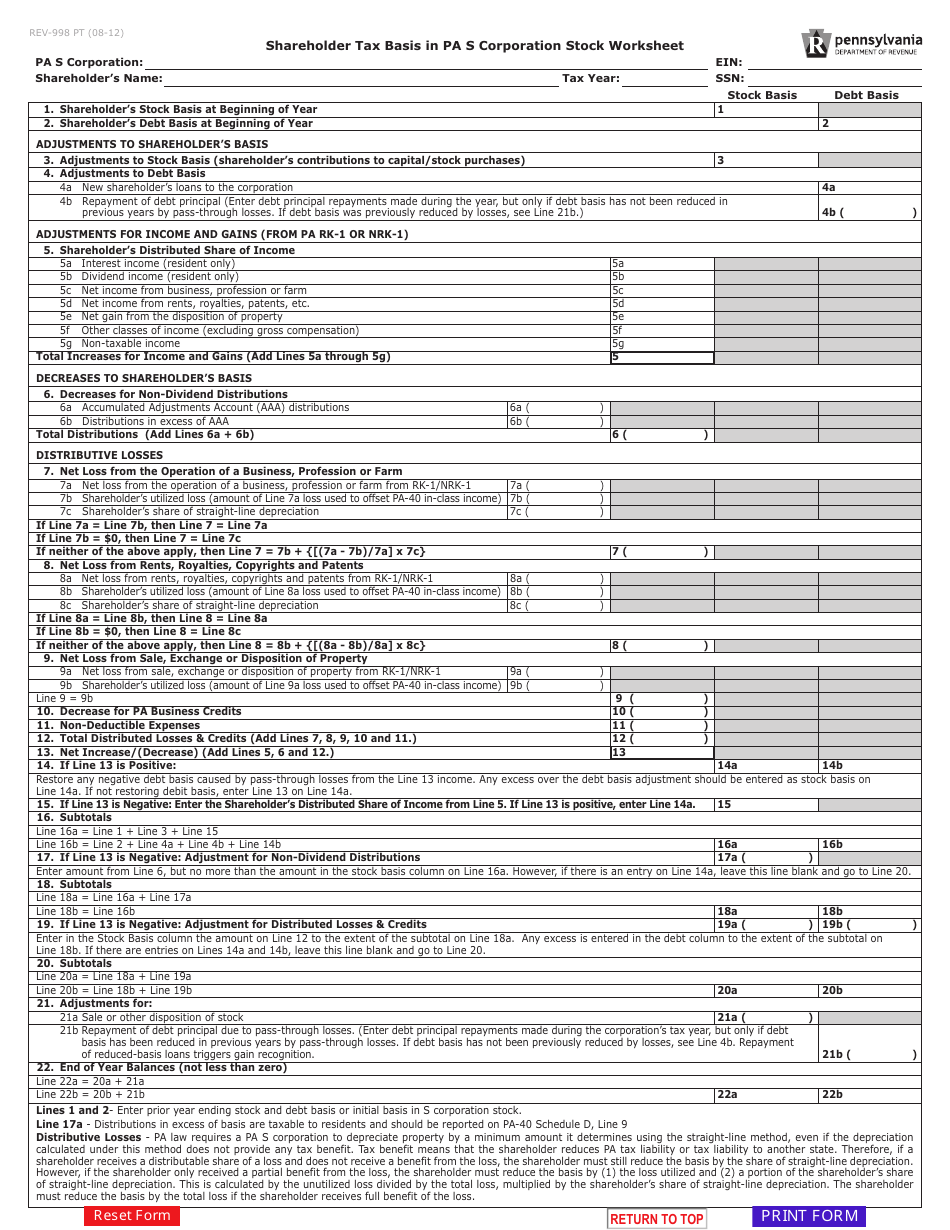

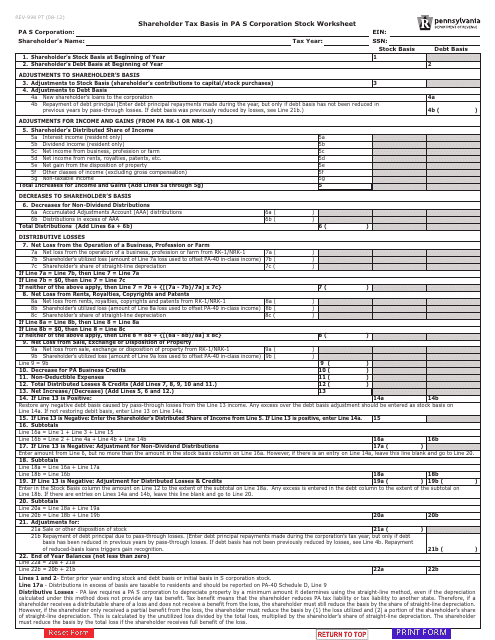

Form Rev 998 Shareholder Tax Basis In Pa S Corporation Stock Worksheet Rev 998

Monthly Balance Sheet Excel Template Balance Sheet Balance Sheet Template Templates Free Design

Business Ownership Transfer Letter How To Write A Business Ownership Transfer Letter Download This Bus Letter Templates Lettering Download Business Template

Irs Form 1120s Schedule K 1 Download Fillable Pdf Or Fill Online Shareholder S Share Of Income Deductions Credits Etc 2018 Templateroller

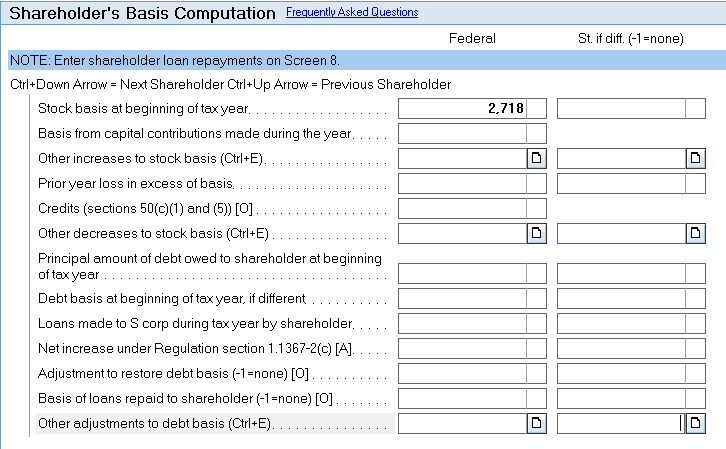

Shareholder Basis Schedule Help S Corp Module Intuit Accountants Community

Form Rev 998 Download Fillable Pdf Or Fill Online Shareholder Tax Basis In Pa S Corporation Stock Worksheet Pennsylvania Templateroller

Form Rev 998 Download Fillable Pdf Or Fill Online Shareholder Tax Basis In Pa S Corporation Stock Worksheet Pennsylvania Templateroller

Mileage Log Reimbursement Form Templates 10 Free Xlsx Docs Pdf Samples Mileage Templates Excel Templates

0 Komentar